ELTI Brochure on Green Investment

In January 2024, ELTI released its latest brochure, presenting 16 lighthouse projects in the field of Green Investment, each supported by their respective NPBI, all of which are members of ELTI.

In January 2024, ELTI released its latest brochure, presenting 16 lighthouse projects in the field of Green Investment, each supported by their respective NPBI, all of which are members of ELTI.

In November 2023, ELTI released its latest brochure, presenting 16 lighthouse projects in the field of Innovation, each supported by their respective NPBI, all of which are members of ELTI.

Prague/Bruxelles, October 20th, 2023 – The members of the European Long-Term Investors (ELTI) Association have gathered in Prague for ELTI’s 11th General Assembly, hosted by ELTI’s Czech member Národní rozvojová banka (NRB) and chaired for the first time by the newly-elected ELTI President Dario Scannapieco, CEO of the Italian National Promotional Institute Cassa Depositi e Prestiti (CDP).

The General Assembly of the Association of European NBPIs was a key moment to discuss the first initiatives to implement the new strategy, which aims to strengthen ELTI's presence in Europe and to reaffirm the importance of NPBIs (National Promotional Banks and Institutions) by favouring long-term investments.

The event, which was attended by representatives of the 31 ELTI members, was an opportunity to share and discuss best practices of cooperation between NPBIs, identifying shared solutions and tools to address upcoming strategically significant challenges facing the European Union. The participants also reflected on how to promote the inclusiveness of the Association by encouraging its expansion to new members, with the aim of making ELTI increasingly the expression of the voice of all EU countries and a more effective instrument at the service of the European institutions.

During ELTI's 10-year anniversary, celebrated in Madrid, ELTI members elected its new President Dario Scannapieco, General Director and CEO of the Italian Cassa Depositi and Prestiti (CDP) for the next 3 years.

Scannapieco commented on his mandate and on the 10th anniversary of the association: “It is a great honour for me to have been appointed today as ELTI President, and I would like to warm-ly thank the former President, Laurent Zylberberg, and all the members of the Association for the trust and support in this journey. ELTI represents 32 National Promotional Banks and Financial Institu-tions of Europe, having doubled its number of members in just 10 years. This diversity of perspectives, coupled with the increased recognition that the association has achieved in many relevant European fora, will represent a key element to keep up with the economic and geopolitical challenges ahead. We have today traced our path for the next 10 years, with new financing commitments for more than 320 bn EUR in 2022, resources that will allow us to strategically support EU strategic objectives, also thanks to a further enlargement to new members. I look forward to chairing ELTI and bringing the Association to the next level - Together we can do more!”

The Investment and Development Fund of Montenegro (IDF) joined the European Association of Long-Term Investors (ELTI) in July 2023, having been officially welcomed during ELTI’s ’10-year anniversary’ event in Madrid. Together with National Promotional Banks and Financial Institutions (NPBIs) from all over Europe, ELTI now represents 32 members from 21 European Member States and candidate countries. ELTI members have a combined balance sheet of more than EUR 2.7 trillion. They are key partners for their national governments and the European Institutions as well as the European Investment Bank (EIB) Group.

NPBIs play an important role as implementing partners of the InvestEU programme and other recovery European programs. As enablers within their respective country, NPBIs are best placed to adapt European financial instruments to the specific needs at national, regional, and local levels. The intensive cooperation between NPBIs within ELTI helps to develop the best solution for each member.

Madrid/Brussels, 20 July 2023 - Today, ELTI is celebrating its 10th anniversary in the country of the EU Presidency, Spain. During this occasion ELTI members have elected its new President Dario Scannapieco, General Director and CEO of the Italian Cassa Depositi and Prestiti (CDP) for the next 3 years.

National Promotional Banks and Institutions (NPBIs) and public Promotional Banks founded the European Long-Term Investors association in Paris in 2013. 10 years later, the association comprises 32 members from 21 EU Member States, 2 candidate countries and in addition 2 International Financial Institutions. The European Investment Bank (EIB) is a permanent Observer in the association. The meeting has also represented the opportunity to validate the new ELTI’s strategic framework for 2023 - 2033, the roadmap that will guide the association actions and priorities for the 10 years to come.

Medical Inventi SA (Poland), PILI (France) and the Social Finance Foundation (Ireland) received the inaugural ELTI Awards in their respective categories at ELTI’s ’10-year anniversary’ event in Madrid today. Made up of 32 National Promotional Banks and Institutions (NPBIs) throughout Europe, the European Long-Term Investors Association (ELTI) marked its 10th year since its inception by organising an award ceremony for various projects funded by its members. The three winners were selected from more than 40 proposals presented by ELTI members, all of which presented outstanding ideas and entrepreneurial approaches in the areas of Innovation, green and sustainable investments and social impact.

On 7 December 2022, Invest-NL, together with the European Association of Long-Term Investors (ELTI), organised a Workshop on 'Impact Investing' in Amsterdam.

Supportive of the goals of the EU Action Plan on Sustainable Finance, there is a huge role to play for National Promotional Banks and Institutions in facilitating societal transitions to enable a sustainable future.

This peer-to-peer learning event was aimed to exchange the latest insights around impact investment policies and how these can be put in practice.

Special thanks to the very inspirational guest speakers: Saara Mattero from the Ilmastorahasto - The Finnish Climate Fund, Clément Damasse from Bpifrance, Cyril Gouiffès from the European Investment Fund (EIF) and Joanne De Jonge from Invest-NL.

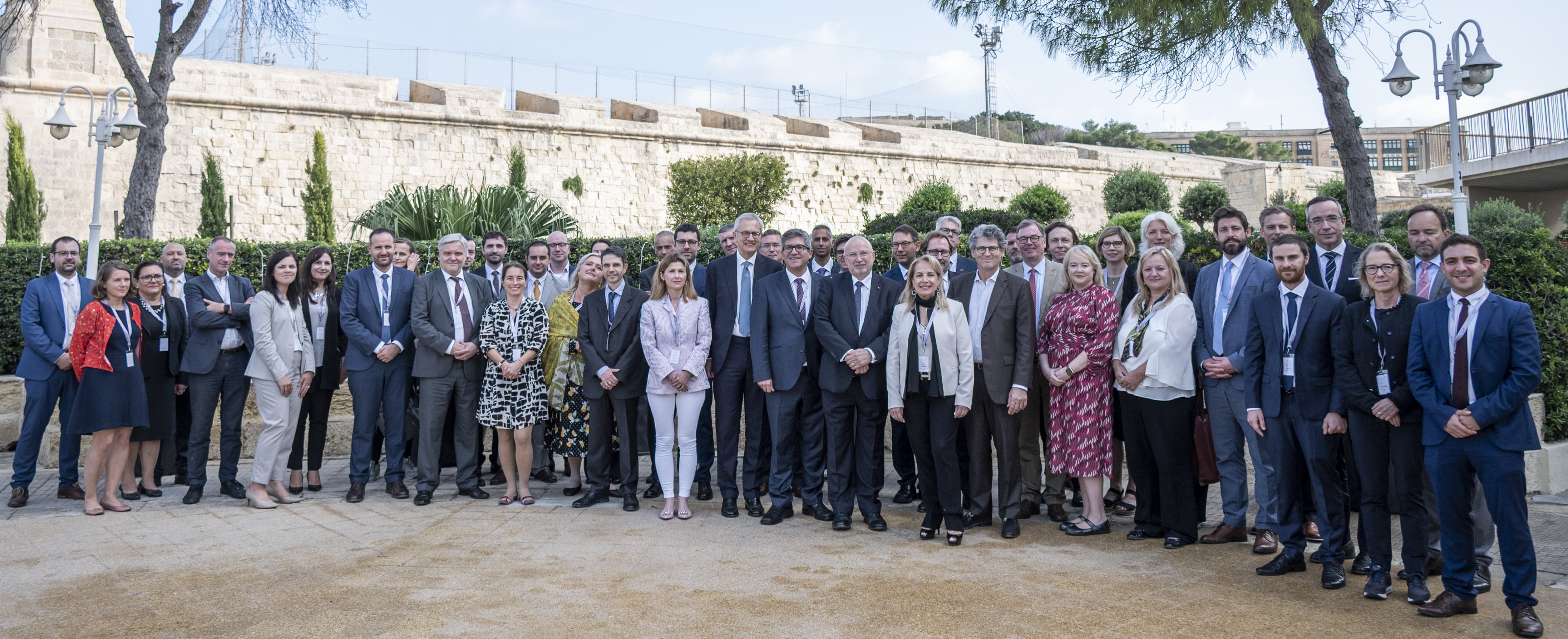

ELTI members held their 2022 General Assembly in Malta. This year saw the association re-electing its Management Board, who will steer the group for the next three years. The panel discussion focused on NPBIs' role during crises as well as the measures taken during the COVID-19 pandemic and the current war in Ukraine. The participants highly appreciated the possibility of discussions with their colleagues from NPBIs of more than 20 EU Member States. The keynote speech (on Malta’s economic success and the challenges ahead) was delivered by Ian Borg, Manager Economic Analysis Department at the Central Bank of Malta. President Laurent Zylberberg once again welcomed representatives from the European Commission and the European Investment Fund who participated intensively in the discussions.

On 16 May 2022 the European Commission published a targeted amendment of the EU Financial Regulation, “aiming to strike the right balance by focusing on changes that are really necessary” and included “targeted improvements”, not least on “strengthening the protection of the Union financial interests”.

Due to the absence of impact assessment the effect of the proposed changes on EU Financial Instruments and the benefit of a greater reliance on Implementing Partners was not estimated. Such an assessment would have demonstrated that some of the proposed changes will de facto strongly discourage and consequently slow down the use of EU Financial Instruments, especially for SMEs and small-scale projects. Additionally, some proposals considerably reduce the discretion of the legislator in terms of crisis policy tools and instruments such as REPowerEU.

In this context, the ELTI association would like to highlight proposals based on the practical experience of national promotional banks and institutions (NPBIs) which are implementing partners (IPs) of EU funds, operating directly and/or with financial intermediaries.

European Long-Term Investors a.i.s.b.l.

Rue Montoyer 51

B - 1000 Brussels

Belgium