Strategic Banking Corporation of Ireland

Background and Context

Unlike many European countries, Ireland did not have a state development bank to sustain funding to businesses throughout the financial crisis. During Ireland’s exit from the EU/IMF programme in late 2013, the Taoiseach and Chancellor Merkel agreed that the German promotional bank Kreditanstalt für Wiederaufbau (KfW) would help finance the Irish SME sector. It was this European agreement that led to the creation of the Strategic Banking Corporation of Ireland (SBCI), ensuring that in future, Irish businesses have access to long-term, patient funding.

The Department of Finance and the National Treasury Management Agency worked throughout 2014 to create the necessary mechanisms to establish the SBCI. Building on the initial funding offer from the KfW, the project team added funding from the European Investment Bank (EIB) and the Ireland Strategic Investment Fund, a new fund to which the assets of the National Pensions Reserve Fund were transferred.

The Government approved this approach and legislation enabling the establishment of the SBCI was passed by the Oireachtas in July 2014.

The SBCI was formally launched by the Minister for Finance, Michael Noonan, TD on 31st October 2014, in conjunction with Minister Howlin, TD, the German Minister for Finance, Dr. Wolfgang Schäuble, President Werner Hoyer of the EIB and Dr Ulrich Schröder of the KfW.

About Us

If you have big plans for your small business, the SBCI can help you fund them. A new, strategic SME funding company, the SBCI’s goal is to ensure access to flexible funding for Irish SMEs by facilitating the provision of:

• Flexible products with longer maturity and capital repayment flexibility, subject to credit approval;

• Lower cost funding to financial institutions, the benefit of which is passed on to SMEs;

• Market access for new entrants to the SME lending market, creating real competition.

All of these elements create a more competitive and dynamic environment for SME funding. The SBCI is a vital new part of the country’s financial architecture. By taking a fresh approach to funding SMEs in Ireland, the long-term potential of the sector to drive economic growth and job creation will be actively supported.

How will the funds get from the SBCI to my business?

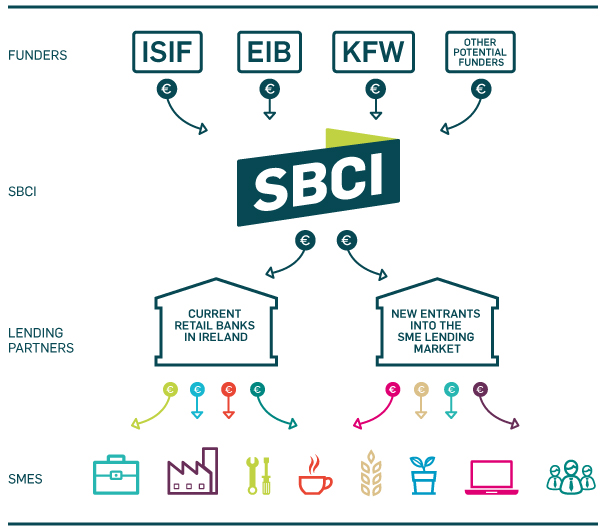

The funding is available to SMEs through both bank and non-bank specialist on-lenders.

The release of long-term funds by promotional (or state-backed) financial institutions, through frontline (or traditional) finance providers, is a successful and effective model for funding SMEs throughout Europe.

The SBCI is currently working with non-bank financial institutions (such as leasing and invoice discounting providers) to expand the range of products available for the Irish SME sector in order to deliver choice and competition.

Who is funding the SBCI?

The SBCI has long-term funding agreements with:

• European Investment Bank (EIB)

• Kreditanstalt für Wiederaufbau (KfW)

• Ireland Strategic Investment Fund (ISIF)

• Council of Europe Development Bank (CEB)

• Funding and Debt Management unit of the National Treasury Management Agency (NTMA)

The lower cost funding provided by SBCI’s partners is passed on to SMEs in the form of a reduced, more competitive funding cost than is usually available in the Irish market.