To celebrate 70 years of sustainable finance, KfW held their 2018 annual reception on 7 November 2018 at the Résidence Palace on Rue de la Loi 155, 1040 in Brussels.

Events

KfW celebrates 70th anniversary

MFF Post-2020 Workshop: What can NPBIs bring to the table for territorial investment?

The European Association of Long-Term Investors (ELTI) is happy to invite you to a workshop on Tuesday 9 October 2018 on MFF Post-2020: What can NPBIs bring to the table for territorial investment.

ELTI-LTIIA Social Infrastructure Workshop

Programme Agenda

Following the publication of the report of the high-level task force on investing in social infrastructure, European Long-Term Investors Association and Long-Term Infrastructure Investors Association are delighted to announce a Social Infrastructure Workshop on Thursday, 27 September 2018.

Warsaw General Assembly

Agenda

The 5th annual ELTI General Assembly will take place in Warsaw, Poland on 27 October 2017 courtesy of the Bank Gospodarstwa Krajowego (BGK)

ELTI Workshop 'Boosting Investment in Social Infrastructure'

Agenda Invitation

High quality health, education and social housing services are as crucial as energy or digital infrastructure when it comes to building resilient and competitive territories. In February 2017, ELTI launched a dedicated high-level task force – under the aegis of the EC and with the involvement of NPBIs and of the EIB – aiming to identify the needs for future investments and the financial models for social infrastructure to promote financing for this sector, something that is crucial for sustainable and inclusive growth. We will discuss how to relaunch social infrastructure financing in the EU, based on the initial findings of the High Level Task Force and with the presentation of concrete local examples of successful investments in the sector. You will find enclosed a draft agenda for the workshop.

EP Intergroup on Long-Term Investment

Financing the social housing sector: which models?

Date: 21 May 2021 - 9:00 AM - 10:30 AM (CEST)

Register Here

Background

The recession following the COVID-19 pandemic grants an increasing role to housing, making it especially harder for the most deprived to work in decent conditions. At the same time, social housing is considered an essential lever to achieve energy efficiency objectives and fight against energy poverty, as set out by the Renovation Wave. It is finally a key principle in the implementation of the European Pillar of Social Rights. As a result, adequate and sufficient sources of funding are required.

This webinar will be the occasion to explore different models of financing of the social housing sector in Europe and how they can be articulated. National Promotional Banks and Institutions (NPBIs), long-term investors, very active in financing social housing will share their experience in articulating national public resources, EU funding and private capital, along social impact private investors and experts on the field.

Simona Bonafé (S&D), Maria da Graça Carvalho (EPP) and Dominique Riquet (RE), are pleased to invite you to the next conference of the Sustainable, Long-term Investments & Competitive European Industry Intergroup on Financing the social housing sector: which models?.

This session will be the occasion to explore different models of financing of the social housing sector in Europe and how they can be articulated in the context of the recession following the COVID-19 pandemic, the energy efficiency objectives set out by the Renovation Wave, and the implementation of the European Pillar of Social Rights.

Keynote by Nicolas Schmit, Commissioner for Jobs and Social Rights

Confirmed speakers:

- Valentina Superti, Director of Tourism and proximity, DG Grow, European Commission

- Francesco Profumo, President of ACRI (Associazione di Fondazioni e di Casse di Risparmio) and President of the Fondazione Compagnia San Paolo

- François de Borchgrave, Founder and Managing Partner, KOIS

- Marco Doglio, Chief Real Estate Officer - Cassa Depositi e Prestiti & CEO - CDP Immobiliare SGR

- Sorcha Edwards, Secretary General, Housing Europe

- Laurent Ghekiere, European Affairs Director, Union Sociale de l’Habitat on the European alliance for Sustainable and inclusive social housing

Moderated by Helmut Helmut von Glasenapp, ELTI Secretary General

European Parliament Intergroup on Long-Term Investment

On Wednesday 23 November 2016 the European Parliament Intergroup on Long-Term Investment and Reindustrialisation met in Strasbourg. Under the chair of the Member of the European Parliament (MEP) Dominique Riquet (FR) and Vice-President of the European Parliament Adina-Ioana Vălean, EFSI was discussed for 1 ½ hours.

On Wednesday 23 November 2016 the European Parliament Intergroup on Long-Term Investment and Reindustrialisation met in Strasbourg. Under the chair of the Member of the European Parliament (MEP) Dominique Riquet (FR) and Vice-President of the European Parliament Adina-Ioana Vălean, EFSI was discussed for 1 ½ hours.

Ca. 50 persons of which 9 were MEPs – one of them being EFSI co-rapporteur José-Manuel Fernandes, and many assistants to MEPs (including to the European Parliament’s President Martin Schultz) attended the meeting.

Based on the three ELTI position papers, the main points of the discussion were: The European Fund for Strategic Investment (EFSI), ART. 38 CPR – European Fund for Strategic Investments (EFSI) & European Structural and Investment Funds (ESI) and the External Investment Plan (EIP).

Madrid General Assembly

Agenda

The 4th annual ELTI General Assembly took place on 28 October 2016 in Madrid, Spain, courtesy of the Instituto de Crédito Oficial (ICO)

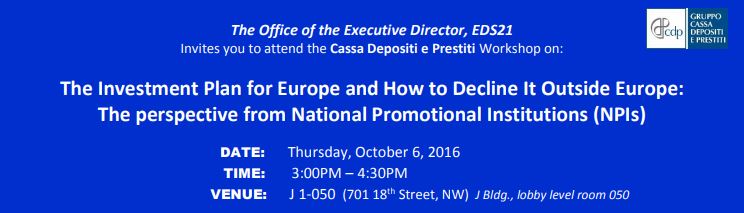

CDP Workshop: The Investment Plan for Europe and How to Decline It Outside Europe: The perspective from National Promotional Institutions (NPIs)

The Investment Plan for Europe and How to Decline It Outside Europe: The perspective from National Promotional Institutions (NPIs)

Europe is now facing one of the most important challenges of its recent history with ongoing great demographic, political, financial and economic changes regarding mainly its internal equilibrium, the relationships within the Mediterranean region, and worldwide balances.

The European Central Bank intervention alone is not sufficient anymore to restore economic activity and support the business cycle in Europe. There is a broad consensus about the need to stimulate the aggregate demand by re-launching investments in order to achieve sustainable and inclusive growth, improving the levels of stability of economic system.

In last years, NPIs have been playing a significant role in sustaining both national and European economies. Their role has become more and more important and the range of available financial tools has widened in response to the evolution of the global scenario. In a period with an abundant liquidity supply, these institutions have been asked to support economic activity by playing a promotional role in the Investment Plan for Europe (also known as Juncker Plan).

Nowadays, the European Union is working to implement an External Investment Plan aiming to support investments in regions outside the EU as a vehicle to tackle the root causes of migration, while contributing to the achievement of Sustainable Development Goals. This Plan could be crucial to help facing the long-lasting refugee crisis and to re-affirm Europe’s role at global level.

High-level Conference: Communicating investment at EU, national, regional and local level

Conference Programme

Venue: European Committee of the Regions, rue Belliard 99-101, 1000 Brussels

A one-day event for networking, sharing communication best practices and discussing about communication challenges related to investment in EU countries.

The high-level conference "Communicating investment at EU, national, regional and local level" took place in Brussels on July 1st 2016. It was conceived as a one-day event for networking, sharing communication best practises and discussing communication challenges related to investment in EU countries. The event brought together communication experts active in investment promotion and communication from across the EU, both from private and public sectors. Leaders of EU structural funds managing authorities were also present as well as representatives of the EU institutions and the European Investment Bank. Together they had the opportunity of brainstorming and raising awareness about communication activities related to EU funds and the Investment Plan for Europe. Case studies Case studies from Bulgaria, Extremadura, Flanders and Vienna as well as a moderated brainstorming session with conference participants were presented and a panel debate took place in the morning while in the afternoon participants were invited to think about communication challenges and identify topics to be discussed in small groups.